How to Identify the Best Term Insurance Plan That Fits Your Budget

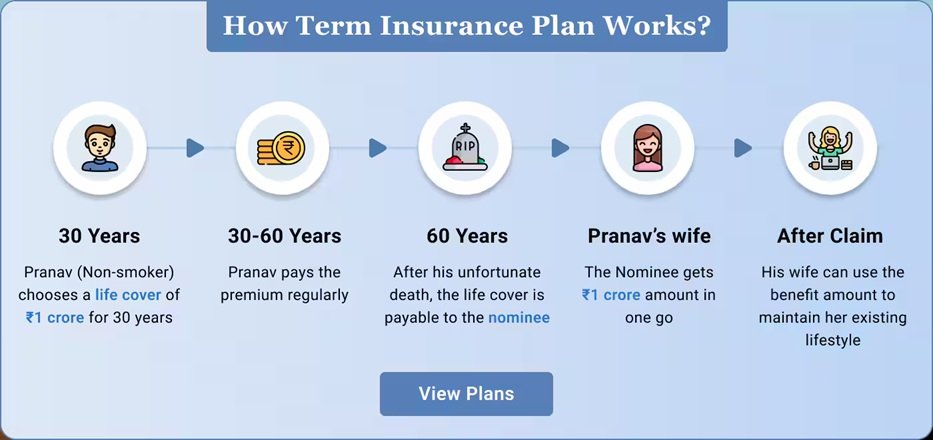

You must consider how to plan your finances in order to secure your family’s future, and a life insurance policy is just one of the elements that should be taken into account. The best term insurance plan is a very simple but efficient way of taking care of your loved ones in case of an untimely eventuality.

However, with this many policies available, how do you pick the one that fits you without compromising your financial standing? The trick is to strike a balance between the size of the coverage, the amount of add-ons required, and the affordable premiums–in such a way that it fits your personal financial goals.

Assess Your Coverage Requirements

You should consider your financial obligations before choosing the correct policy because that will give your family what they need when you are not there to look after them.

Factors to be considered when calculating coverage:

- Outstanding loans: Consider the mortgages, personal loans and car loans which your family may require some help in after you die.

- Household costs: Include costs of living (groceries, bills, and care of kids).

- Future achievements: Strategy of higher education of children or a spouse’s retirement income.

- Emergency funds: Act to provide a buffer against unexpected medical or financial emergencies.

Generally, a rule of thumb would mean to cover 10-15 times your yearly income. This can be used to cut down the best term insurance plans.

Look for Competitive Premiums

This needs to be fully covered, but the premiums should be affordable. Here are some hints on how to manage premiums:

- Early purchase: When one buys a term plan at an early age, the premium rates are usually the lowest.

- Annual payments: Annual payments tend to be cheaper than monthly payments.

- Healthy lifestyle: Non-smokers are usually regarded as healthier and tend to be charged lower premiums by insurance companies.

- Online calculators: A lot of different insurers offer online calculators that help you to find the appropriate balance between insurance and price.

A good premium will mean that you can afford to remain on the policy in the long run without financial strain.

Add Essential Riders for Extra Protection

Riders or add-ons help to enhance your policy by providing coverage on certain risks. They pay a low extra premium, but they provide great peace of mind.

Popular riders to add:

- Critical illness rider: It is a lump sum paid out when you are diagnosed with a critical illness such as cancer or heart disease.

- Accidental death rider: This is an additional cover that will be paid out in the event of an accidental death.

- Waiver of premium rider: Allows you to keep your policy alive in the event you are unable to work due to illness or disability.

- Income benefit rider: This pays you a fixed income rather than a lump sum to your family.

When choosing the ideal mix of riders, you can be assured of comprehensive and personalised coverage under your term insurance plan.

Compare Providers and Policies Carefully

Do not take the first option you come across. The keys to an informed choice are research and comparison.

Important points to check:

- Claim settlement ratio: The better the ratio, the more trusted the insurer and the better the history of settlement of claims.

- Customer reviews: The feedback of policyholders can help you figure out the service level.

- Flexibility: Determine whether the insurer offers the flexibility to adjust coverage or riders as your needs vary.

- Exclusions and the fine print: This is to know exactly what is not covered to avoid being surprised when you have to claim.

The time spent in making a comparison pays off in getting the best out of an investment.

Conclusion: Secure Your Family’s Future Wisely

There is no need to make a complex choice of a term insurance policy. With the right riders, matching your coverage with your liability and ensuring you keep the premium affordable, you can afford to secure your family’s future without flying a kite.

Keep in mind that the best plan is not always the most affordable one, but also a good insurance policy against any uncertainties in life. Make that long-term financial liberty decision today and give it to those you love.